To win approval for Epidiolex, the first cannabis-derived drug cleared by the U.S. Food & Drug Administration, GW Pharmaceuticals took no chances.

The active ingredient in Epidiolex is cannabidiol (CBD), a compound in cannabis that doesn’t produce a high, unlike tetrahydrocannabinol (THC), the plant’s psychoactive component. The U.S. government considers cannabis an illegal drug, so any pharmaceutical derived from it must be closely monitored for diversion and carefully manufactured for purity and chemical consistency.

Covering all its bases, GW set up giant greenhouses north of London where it raises cannabis plants under highly controlled conditions. It built facilities to extract CBD and crystallize purified CBD from the extract. Anticipating growing demand for Epidiolex, GW recently added extraction and purification capacity and is planning even more.

GW demonstrated that a drug extracted from cannabis can be approved in the U.S., despite the federal government’s hostility to cannabis. Today, more than 100 drug companies are furiously testing myriad new products, in dozens of therapeutic areas, based on CBD and other cannabinoids present in the cannabis plant.

Yet some pharmaceutical chemical companies consider GW an aberration in the emerging field of cannabinoid drugs. These firms are investing in R&D, analytical capabilities, and manufacturing facilities in the U.S. to support production of cannabinoids via organic chemistry rather than extraction from the cannabis plant. They are betting that the future of cannabinoid therapeutics will be synthetic.

Of these firms, Noramco is the most aggressive in its pursuit of the cannabinoid market. Founded in 1979, Noramco is licensed by the U.S. Drug Enforcement Administration to produce controlled substances such as codeine, morphine, and oxycodone in bulk for drug industry customers. It also makes amphetamines and naloxone, the active ingredient in opioid overdose antidotes.

Noramco was a unit of Johnson & Johnson until 2016, when the private equity firm SK Capital acquired it for a reported $800 million. Noramco added THC to its portfolio 10 years ago at the request of a customer, but under James Mish, who became CEO soon after the acquisition, cannabinoids are now front and center. “We have remodeled the entire organization to refocus around these products,” Mish said during a briefing at the CPhI Worldwide pharmaceutical chemical trade show in Madrid last month.

To complement the CBD and THC it gets from a manufacturing partner in Switzerland, Noramco began making clinical quantities of CBD last year at its own facility in Athens, Ga. Early next year, the firm said, it will begin larger-scale production of CBD in Wilmington, Del., and THC in Athens. Noramco will be the only company that uses chemical synthesis to make commercial quantities of pharmaceutical-grade CBD and THC, Mish said.

Mish made clear that those are not the only cannabinoids that Noramco is pursuing. “THC and CBD are just scratching the surface of the plant,” he said.

Bill Grubb, Noramco’s vice president of business development and innovation, explained that the cannabis plant contains 400 chemicals, of which about 60 are cannabinoids. Ten of those, he said, have been shown to have potential pharmaceutical benefits. Noramco stocks research quantities of all 10, Grubb said, plus 22 others.

Demand, Noramco executives said, is exploding. A year ago the firm had 10 customers working on eight therapeutic areas; today it has about 120 customers, including some big pharma firms, pursuing 80 therapeutic areas. At the briefing, Noramco disclosed three small customers: Axim Biotechnologies, which is developing a chewing-gum-released THC for nausea; Cardiol Therapeutics, which is working on a CBD-based heart failure drug; and RespireRx Pharmaceuticals, which is developing a THC-containing obstructive sleep apnea treatment.

The British firm Johnson Matthey is another veteran of the synthetic cannabinoid field. Like Noramco, JM is a longtime producer of opioids in possession of the Drug Enforcement Administration licenses needed to make cannabinoids.

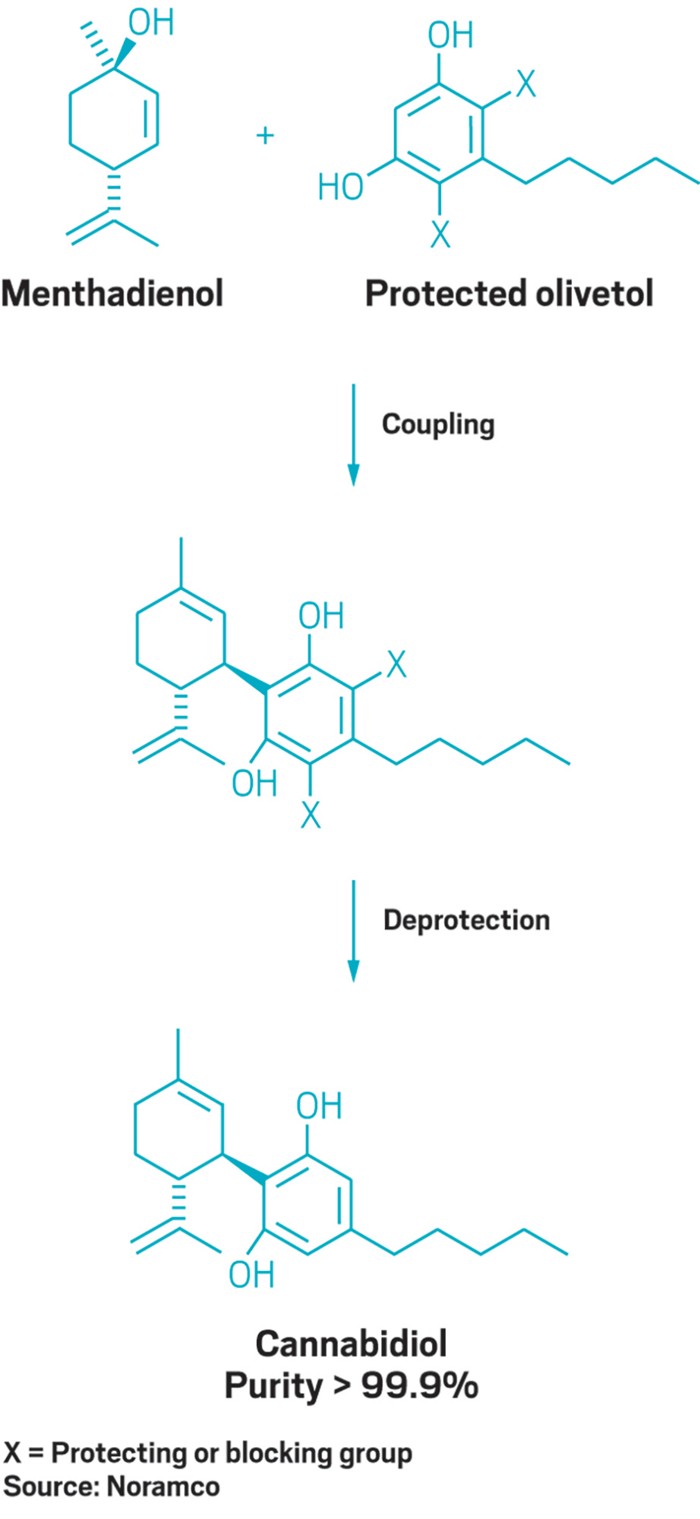

CBD made simple →

Noramco says the well-characterized starting materials and high-purity result of its cannabidiol synthesis will appeal to regulators.

Kevin Hennessy, JM’s commercial director for North America, says the company got into the business more than 15 years ago when it helped a customer develop a generic substitute for Marinol, a synthetic THC-containing drug that chemotherapy patients take to treat nausea. Now marketed by AbbVie, Marinol was the first cannabinoid-based product that FDA approved when the drug debuted in 1985.

To support the launch of the generic, JM invested tens of millions of dollars in supercritical fluid chromatography and other equipment at its West Deptford, N.J., plant, to achieve the high purity needed to prevent THC from oxidizing readily, Hennessy says. “A lot of expertise was generated around cannabinoids as we developed THC,” he says.

JM is now applying that expertise to CBD. In September the company revealed that it has developed a new synthetic method, different from the one followed by Noramco, for CBD production. Hennessy says the firm has been selling CBD for about a year now and that its process can be scaled to the metric ton level.

Like Noramco, JM is active in other cannabinoids. For example, Hennessy says, the firm supplies nabilone, a THC-like molecule, to generic drug makers in Canada, where nabilone is widely used to manage chronic pain. And JM is scouting out routes to other molecules, such as dexanabinol, as drug companies advance them through clinical trials.

Not everyone is convinced that chemical synthesis is the best source of compounds that are so readily available in the cannabis plant. At the CPhI conference, C2 Pharma announced a pact with Anklam Extrakt to develop CBD and other extracts from the cannabis plant that meet the Good Manufacturing Practice (GMP) standards required for the drug industry.

C2 Pharma, based in Luxembourg, produces drug ingredients, including several extracted from plants. Anklam Extrakt, based in Anklam, Germany, is a producer of botanical extracts that follows GMP guidelines. The two hope to have initial samples early next year. C2 Pharma said it is also working on collaborations in cultivation, extraction technology, and analytical methods “to meet the specific needs of the burgeoning cannabis industry as a medicinal product in Europe and globally.”

And GW argues for the superiority of cannabinoid extracts over synthesized molecules. Stephen Schultz, the firm’s vice president of investor relations, explains that GW breeds plants with cannabinoid ratios it expects will treat specific diseases. If clinical trials bear out its hypotheses, the firm clones the plants and then extracts the cannabinoids on a large scale.

“That process allows us to have a complex chemical fingerprint that is considered a single moiety by the FDA,” Schultz says. It’s a better way to discover drugs, he claims, and better for long-term protection of intellectual property since complex mixtures will be difficult to copy.

Epidiolex is something of an anomaly, Schultz notes, in that it is more than 98% CBD. GW’s first product, Sativex—a muscular dystrophy treatment approved elsewhere in the world and planned for U.S. launch—is a mixture of CBD and THC. For drugmakers developing treatments with a “complex cannabinoid fingerprint,” Schultz says, synthetic routes are impractical.

But firms like Noramco and JM maintain that GW will prove to be an exception in the cannabinoid world. At the briefing, Noramco’s Mish painted a future landscape in which the recreational and nutraceutical markets are served by CBD and THC extracted from plants, and the pharmaceutical market is served by synthetics. “In order to get the quality needed by regulatory bodies, the only way to do that is synthetically,” he said.

GW, he argued, began to pursue Epidiolex before adequate supplies of synthetic CBD were available. “Had the option been there,” Mish said, “they might have opted for a synthetic pathway.” He predicted that other firms will find it difficult to get “grow and extract” drugs past FDA.

What synthetics offer, according to the Noramco executives, are purity and consistency. Josh Hoerner, managing director for innovation and product development, noted that firms getting cannabinoids from cannabis must contend with impurities in the plant, heavy metals in the growing medium, pesticide residues, and harsh extraction solvents.

In contrast, both Noramco and JM say their syntheses start with well-characterized starting materials and yield high-purity white powders.

That’s not to say that chemical makers aren’t keeping their options open. Noramco signed an agreement with Teewinot Life Sciences, which developed a biocatalytic route to drug-grade cannabinoids, including products in the “varin” series, such as tetrahydrocannabivarin, a possible diabetes treatment. Noramco has also worked with the synthetic biology firm Ginkgo Bioworks on fermentation routes to cannabinoids.

In Madrid, Noramco executives said they are keeping their production options open because the field is evolving so quickly. For now, they are waiting to see what cannabinoids advance in clinical trials. But thanks to synthetic organic chemistry, Mish said, Noramco is ready to supply any that prove therapeutically effective. “It’s not something we are developing,” he said. “We have them.”

Chemical & Engineering News

ISSN 0009-2347

Copyright © 2018 American Chemical Society

Source: C&EN

Based on +200

reviews

Based on +200

reviews